57. The Income Fluctuation Problem II: Stochastic Returns on Assets#

Contents

In addition to what’s in Anaconda, this lecture will need the following libraries:

!pip install quantecon

Show code cell output

Requirement already satisfied: quantecon in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (0.8.1)

Requirement already satisfied: numba>=0.49.0 in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from quantecon) (0.60.0)

Requirement already satisfied: numpy>=1.17.0 in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from quantecon) (1.26.4)

Requirement already satisfied: requests in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from quantecon) (2.32.3)

Requirement already satisfied: scipy>=1.5.0 in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from quantecon) (1.13.1)

Requirement already satisfied: sympy in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from quantecon) (1.14.0)

Requirement already satisfied: llvmlite<0.44,>=0.43.0dev0 in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from numba>=0.49.0->quantecon) (0.43.0)

Requirement already satisfied: charset-normalizer<4,>=2 in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from requests->quantecon) (3.3.2)

Requirement already satisfied: idna<4,>=2.5 in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from requests->quantecon) (3.7)

Requirement already satisfied: urllib3<3,>=1.21.1 in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from requests->quantecon) (2.2.3)

Requirement already satisfied: certifi>=2017.4.17 in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from requests->quantecon) (2024.8.30)

Requirement already satisfied: mpmath<1.4,>=1.1.0 in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from sympy->quantecon) (1.3.0)

57.1. Overview#

In this lecture, we continue our study of the income fluctuation problem.

While the interest rate was previously taken to be fixed, we now allow returns on assets to be state-dependent.

This matches the fact that most households with a positive level of assets face some capital income risk.

It has been argued that modeling capital income risk is essential for understanding the joint distribution of income and wealth (see, e.g., [Benhabib et al., 2015] or [Stachurski and Toda, 2019]).

Theoretical properties of the household savings model presented here are analyzed in detail in [Ma et al., 2020].

In terms of computation, we use a combination of time iteration and the endogenous grid method to solve the model quickly and accurately.

We require the following imports:

import matplotlib.pyplot as plt

import numpy as np

from numba import jit, float64

from numba.experimental import jitclass

from quantecon import MarkovChain

57.2. The Savings Problem#

In this section we review the household problem and optimality results.

57.2.1. Set Up#

A household chooses a consumption-asset path

subject to

with initial condition

Note that

The sequence

The stochastic components of the problem obey

where

the maps

the innovation processes

Let

Our assumptions on preferences are the same as our previous lecture on the income fluctuation problem.

As before,

57.2.2. Assumptions#

We need restrictions to ensure that the objective (57.1) is finite and the solution methods described below converge.

We also need to ensure that the present discounted value of wealth does not grow too quickly.

When

Now it is stochastic, we require that

Notice that, when

The value

More intuition behind (57.4) is provided in [Ma et al., 2020].

Discussion on how to check it is given below.

Finally, we impose some routine technical restrictions on non-financial income.

One relatively simple setting where all these restrictions are satisfied is the IID and CRRA environment of [Benhabib et al., 2015].

57.2.3. Optimality#

Let the class of candidate consumption policies

In [Ma et al., 2020] it is shown that, under the stated assumptions,

any

exactly one such policy exists in

In the present setting, the Euler equation takes the form

(Intuition and derivation are similar to our earlier lecture on the income fluctuation problem.)

We again solve the Euler equation using time iteration, iterating with a

Coleman–Reffett operator

57.3. Solution Algorithm#

57.3.1. A Time Iteration Operator#

Our definition of the candidate class

For fixed

The idea behind

This means that fixed points of

57.3.2. Convergence Properties#

As before, we pair

It can be shown that

there exists an integer

The unique fixed point of

We now have a clear path to successfully approximating the optimal policy:

choose some

57.3.3. Using an Endogenous Grid#

In the study of that model we found that it was possible to further accelerate time iteration via the endogenous grid method.

We will use the same method here.

The methodology is the same as it was for the optimal growth model, with the minor exception that we need to remember that consumption is not always interior.

In particular, optimal consumption can be equal to assets when the level of assets is low.

57.3.3.1. Finding Optimal Consumption#

The endogenous grid method (EGM) calls for us to take a grid of savings

values

For the lowest grid point we take

For the corresponding

This happens close to the origin, where assets are low and the household consumes all that it can.

Although there are many solutions, the one we take is

For

Hence the max component of (57.5) drops out, and we solve for

at each

57.3.3.2. Iterating#

Once we have the pairs

Also, we held

An approximation of the policy

In what follows, we use linear interpolation.

57.3.4. Testing the Assumptions#

Convergence of time iteration is dependent on the condition

One can check this using the fact that

This identity is proved in [Ma et al., 2020], where

(Remember that

Checking the condition is even easier when

In that case, it is clear from the definition of

We test the condition

57.4. Implementation#

We will assume that

We allow labor income to be correlated, with

where

ifp_data = [

('γ', float64), # utility parameter

('β', float64), # discount factor

('P', float64[:, :]), # transition probs for z_t

('a_r', float64), # scale parameter for R_t

('b_r', float64), # additive parameter for R_t

('a_y', float64), # scale parameter for Y_t

('b_y', float64), # additive parameter for Y_t

('s_grid', float64[:]), # Grid over savings

('η_draws', float64[:]), # Draws of innovation η for MC

('ζ_draws', float64[:]) # Draws of innovation ζ for MC

]

@jitclass(ifp_data)

class IFP:

"""

A class that stores primitives for the income fluctuation

problem.

"""

def __init__(self,

γ=1.5,

β=0.96,

P=np.array([(0.9, 0.1),

(0.1, 0.9)]),

a_r=0.1,

b_r=0.0,

a_y=0.2,

b_y=0.5,

shock_draw_size=50,

grid_max=10,

grid_size=100,

seed=1234):

np.random.seed(seed) # arbitrary seed

self.P, self.γ, self.β = P, γ, β

self.a_r, self.b_r, self.a_y, self.b_y = a_r, b_r, a_y, b_y

self.η_draws = np.random.randn(shock_draw_size)

self.ζ_draws = np.random.randn(shock_draw_size)

self.s_grid = np.linspace(0, grid_max, grid_size)

# Test stability assuming {R_t} is IID and adopts the lognormal

# specification given below. The test is then β E R_t < 1.

ER = np.exp(b_r + a_r**2 / 2)

assert β * ER < 1, "Stability condition failed."

# Marginal utility

def u_prime(self, c):

return c**(-self.γ)

# Inverse of marginal utility

def u_prime_inv(self, c):

return c**(-1/self.γ)

def R(self, z, ζ):

return np.exp(self.a_r * ζ + self.b_r)

def Y(self, z, η):

return np.exp(self.a_y * η + (z * self.b_y))

Here’s the Coleman-Reffett operator based on EGM:

@jit

def K(a_in, σ_in, ifp):

"""

The Coleman--Reffett operator for the income fluctuation problem,

using the endogenous grid method.

* ifp is an instance of IFP

* a_in[i, z] is an asset grid

* σ_in[i, z] is consumption at a_in[i, z]

"""

# Simplify names

u_prime, u_prime_inv = ifp.u_prime, ifp.u_prime_inv

R, Y, P, β = ifp.R, ifp.Y, ifp.P, ifp.β

s_grid, η_draws, ζ_draws = ifp.s_grid, ifp.η_draws, ifp.ζ_draws

n = len(P)

# Create consumption function by linear interpolation

σ = lambda a, z: np.interp(a, a_in[:, z], σ_in[:, z])

# Allocate memory

σ_out = np.empty_like(σ_in)

# Obtain c_i at each s_i, z, store in σ_out[i, z], computing

# the expectation term by Monte Carlo

for i, s in enumerate(s_grid):

for z in range(n):

# Compute expectation

Ez = 0.0

for z_hat in range(n):

for η in ifp.η_draws:

for ζ in ifp.ζ_draws:

R_hat = R(z_hat, ζ)

Y_hat = Y(z_hat, η)

U = u_prime(σ(R_hat * s + Y_hat, z_hat))

Ez += R_hat * U * P[z, z_hat]

Ez = Ez / (len(η_draws) * len(ζ_draws))

σ_out[i, z] = u_prime_inv(β * Ez)

# Calculate endogenous asset grid

a_out = np.empty_like(σ_out)

for z in range(n):

a_out[:, z] = s_grid + σ_out[:, z]

# Fixing a consumption-asset pair at (0, 0) improves interpolation

σ_out[0, :] = 0

a_out[0, :] = 0

return a_out, σ_out

The next function solves for an approximation of the optimal consumption policy via time iteration.

def solve_model_time_iter(model, # Class with model information

a_vec, # Initial condition for assets

σ_vec, # Initial condition for consumption

tol=1e-4,

max_iter=1000,

verbose=True,

print_skip=25):

# Set up loop

i = 0

error = tol + 1

while i < max_iter and error > tol:

a_new, σ_new = K(a_vec, σ_vec, model)

error = np.max(np.abs(σ_vec - σ_new))

i += 1

if verbose and i % print_skip == 0:

print(f"Error at iteration {i} is {error}.")

a_vec, σ_vec = np.copy(a_new), np.copy(σ_new)

if error > tol:

print("Failed to converge!")

elif verbose:

print(f"\nConverged in {i} iterations.")

return a_new, σ_new

Now we are ready to create an instance at the default parameters.

ifp = IFP()

Next we set up an initial condition, which corresponds to consuming all assets.

# Initial guess of σ = consume all assets

k = len(ifp.s_grid)

n = len(ifp.P)

σ_init = np.empty((k, n))

for z in range(n):

σ_init[:, z] = ifp.s_grid

a_init = np.copy(σ_init)

Let’s generate an approximation solution.

a_star, σ_star = solve_model_time_iter(ifp, a_init, σ_init, print_skip=5)

Error at iteration 5 is 0.5081944529506552.

Error at iteration 10 is 0.1057246950930697.

Error at iteration 15 is 0.03658262202883744.

Error at iteration 20 is 0.013936729965906114.

Error at iteration 25 is 0.00529216526971199.

Error at iteration 30 is 0.0019748126990770665.

Error at iteration 35 is 0.0007219210463285108.

Error at iteration 40 is 0.0002590544496094971.

Error at iteration 45 is 9.163966595471251e-05.

Converged in 45 iterations.

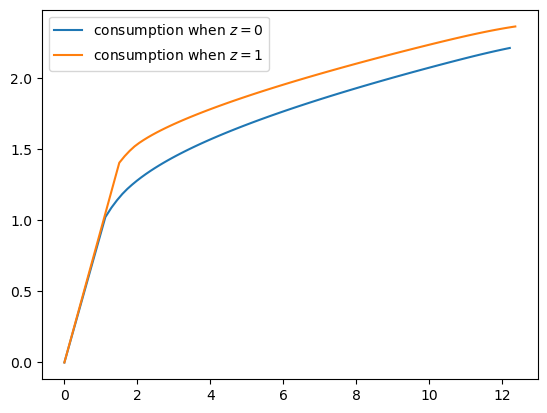

Here’s a plot of the resulting consumption policy.

fig, ax = plt.subplots()

for z in range(len(ifp.P)):

ax.plot(a_star[:, z], σ_star[:, z], label=f"consumption when $z={z}$")

plt.legend()

plt.show()

Notice that we consume all assets in the lower range of the asset space.

This is because we anticipate income

Can you explain why consuming all assets ends earlier (for lower values of

assets) when

57.4.1. Law of Motion#

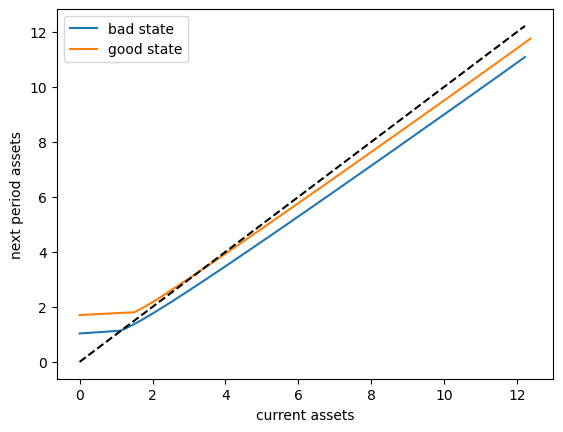

Let’s try to get some idea of what will happen to assets over the long run under this consumption policy.

As with our earlier lecture on the income fluctuation problem, we begin by producing a 45 degree diagram showing the law of motion for assets

# Good and bad state mean labor income

Y_mean = [np.mean(ifp.Y(z, ifp.η_draws)) for z in (0, 1)]

# Mean returns

R_mean = np.mean(ifp.R(z, ifp.ζ_draws))

a = a_star

fig, ax = plt.subplots()

for z, lb in zip((0, 1), ('bad state', 'good state')):

ax.plot(a[:, z], R_mean * (a[:, z] - σ_star[:, z]) + Y_mean[z] , label=lb)

ax.plot(a[:, 0], a[:, 0], 'k--')

ax.set(xlabel='current assets', ylabel='next period assets')

ax.legend()

plt.show()

The unbroken lines represent, for each

Here

The dashed line is the 45 degree line.

We can see from the figure that the dynamics will be stable — assets do not diverge even in the highest state.

57.5. Exercises#

Exercise 57.1

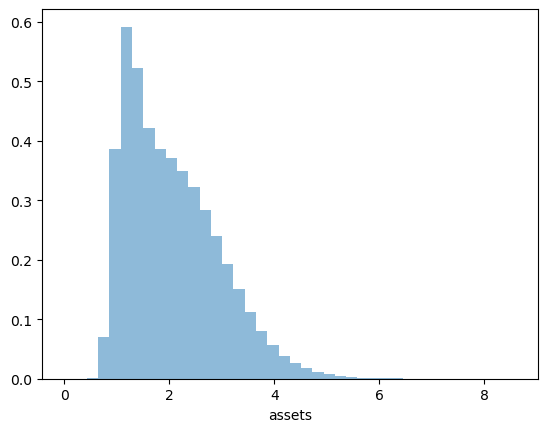

Let’s repeat our earlier exercise on the long-run cross sectional distribution of assets.

In that exercise, we used a relatively simple income fluctuation model.

In the solution, we found the shape of the asset distribution to be unrealistic.

In particular, we failed to match the long right tail of the wealth distribution.

Your task is to try again, repeating the exercise, but now with our more sophisticated model.

Use the default parameters.

Solution to Exercise 57.1

First we write a function to compute a long asset series.

Because we want to JIT-compile the function, we code the solution in a way that breaks some rules on good programming style.

For example, we will pass in the solutions a_star, σ_star along with

ifp, even though it would be more natural to just pass in ifp and then

solve inside the function.

The reason we do this is that solve_model_time_iter is not

JIT-compiled.

@jit

def compute_asset_series(ifp, a_star, σ_star, z_seq, T=500_000):

"""

Simulates a time series of length T for assets, given optimal

savings behavior.

* ifp is an instance of IFP

* a_star is the endogenous grid solution

* σ_star is optimal consumption on the grid

* z_seq is a time path for {Z_t}

"""

# Create consumption function by linear interpolation

σ = lambda a, z: np.interp(a, a_star[:, z], σ_star[:, z])

# Simulate the asset path

a = np.zeros(T+1)

for t in range(T):

z = z_seq[t]

ζ, η = np.random.randn(), np.random.randn()

R = ifp.R(z, ζ)

Y = ifp.Y(z, η)

a[t+1] = R * (a[t] - σ(a[t], z)) + Y

return a

Now we call the function, generate the series and then histogram it, using the solutions computed above.

T = 1_000_000

mc = MarkovChain(ifp.P)

z_seq = mc.simulate(T, random_state=1234)

a = compute_asset_series(ifp, a_star, σ_star, z_seq, T=T)

fig, ax = plt.subplots()

ax.hist(a, bins=40, alpha=0.5, density=True)

ax.set(xlabel='assets')

plt.show()

Now we have managed to successfully replicate the long right tail of the wealth distribution.

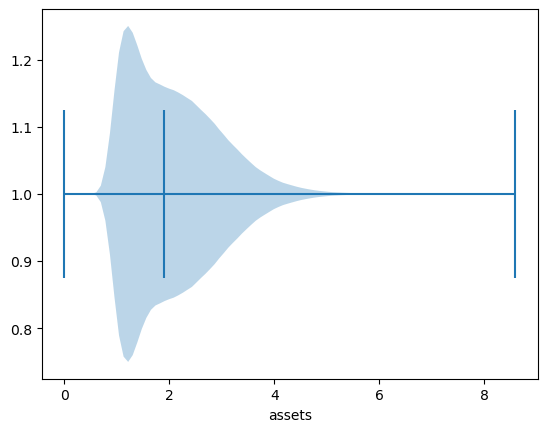

Here’s another view of this using a horizontal violin plot.

fig, ax = plt.subplots()

ax.violinplot(a, vert=False, showmedians=True)

ax.set(xlabel='assets')

plt.show()